***

Contents

- 1 Credit Lite Review: The Ultimate Multi Branch Loan & Savings Management System PHP Script

- 1.1 A Deep Dive into Credit Lite’s Key Features

- 1.2 Usability and Interface

- 1.3 Security and Performance

- 1.4 Pricing and Value

- 1.5 Credit Lite: Pros and Cons at a Glance

- 1.6 Frequently Asked Questions (FAQs)

- 1.6.1 1. What is the Credit Lite Management System?

- 1.6.2 2. Who is this script for?

- 1.6.3 3. What technical skills are needed to install it?

- 1.6.4 4. Is the system secure for handling financial data?

- 1.6.5 5. Can I customize the script to fit my needs?

- 1.6.6 6. Where can I buy the Credit Lite PHP script?

- 1.6.7 7. Does it support different currencies?

- 1.6.8 8. Is a live demo available to test?

- 1.7 Final Verdict: Is Credit Lite Worth Buying?

Credit Lite Review: The Ultimate Multi Branch Loan & Savings Management System PHP Script

Managing a financial institution, whether it’s a microfinance company, a credit union, or a savings and loans cooperative (SACCO), comes with immense complexity. You need to handle loan applications, track repayments, manage savings accounts, and oversee multiple branches, all while ensuring data security and accuracy. This is where a robust digital solution becomes essential. The Credit Lite Multi Branch Loan & Savings Management System is a powerful PHP script designed to streamline these exact operations. In this comprehensive Credit Lite Multi Branch Loan & Savings Management System PHP script review, we’ll dive deep into its features, usability, and overall value to help you decide if it’s the right fit for your organization.

A Deep Dive into Credit Lite’s Key Features

Credit Lite isn’t just a basic ledger; it’s a full-fledged management ecosystem built to handle the diverse needs of modern lending institutions. Its feature set is extensive, providing end-to-end control over your financial operations. What makes it stand out as one of the best PHP script for Laravel Vue developers and users alike is its comprehensive and well-integrated functionality.

Here are some of the standout features:

- Multi-Branch Management: This is the script’s core strength. You can create and manage unlimited branches from a single admin panel. Each branch can have its own staff, borrowers, and financial records, while the central administration maintains complete oversight.

- Comprehensive Loan Management: The system covers the entire loan lifecycle. This includes creating loan products with custom interest rates and repayment schedules, processing applications, performing approvals, disbursing funds, and tracking repayments. It also includes features for collateral management and handling guarantors.

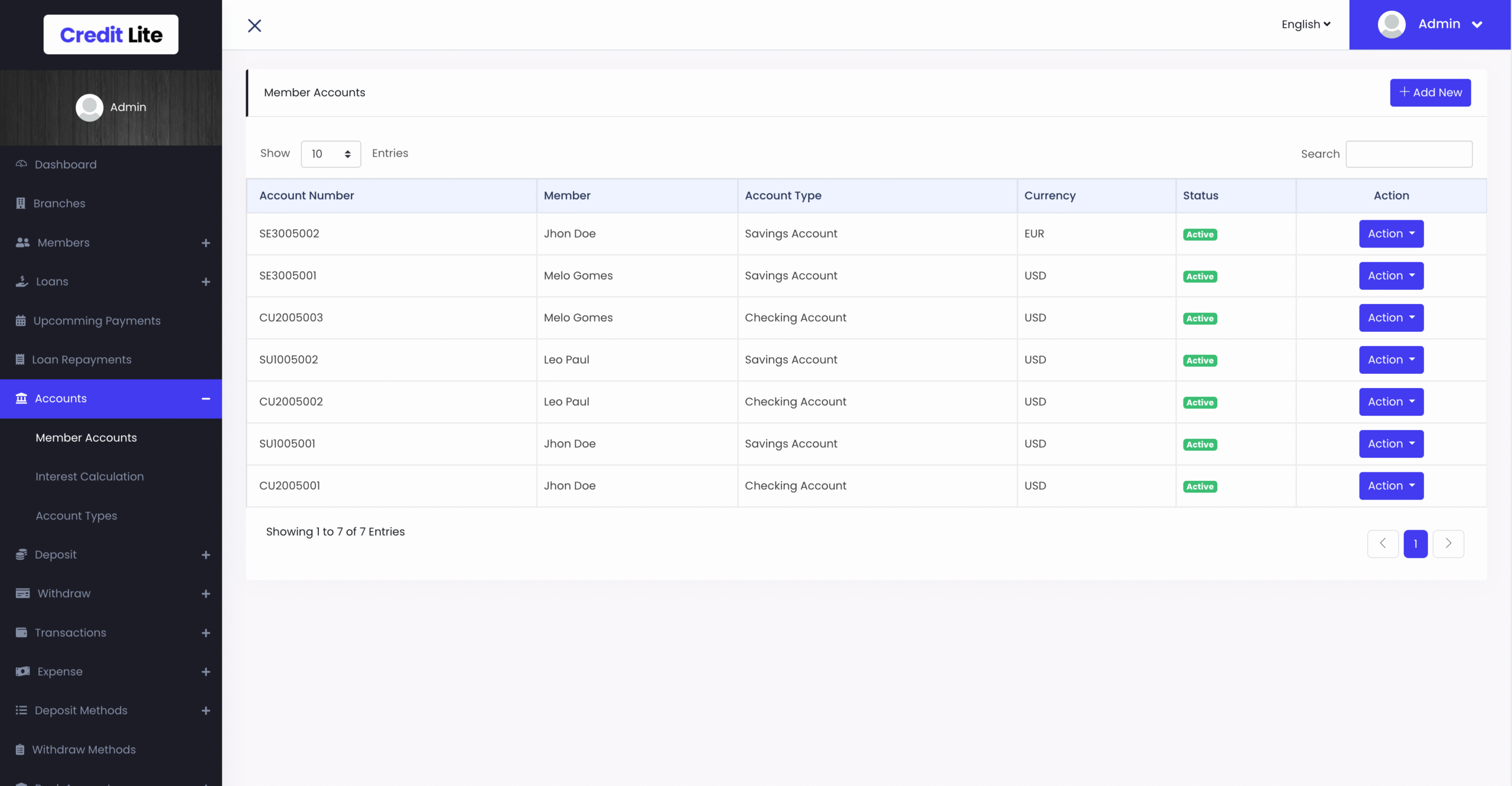

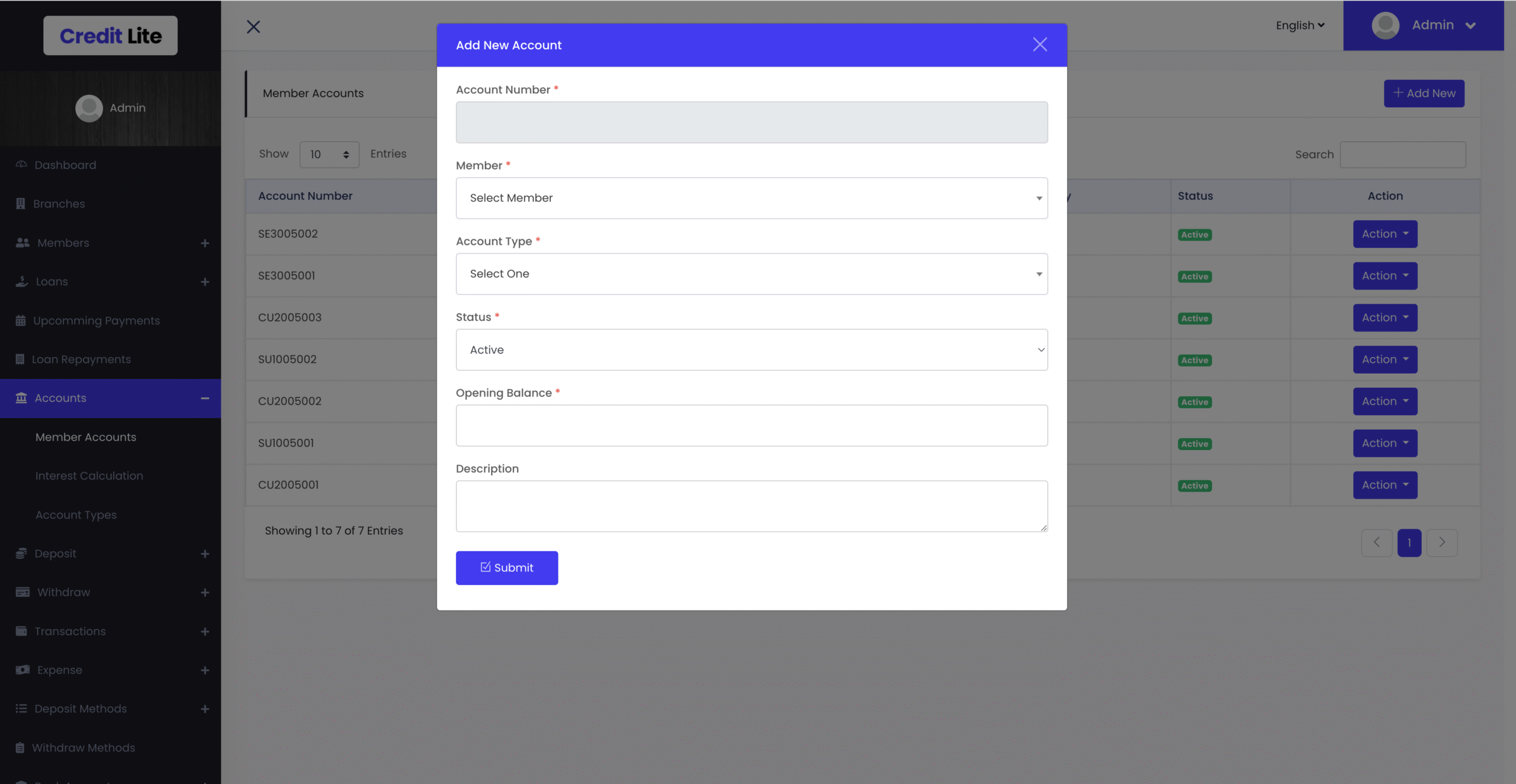

- Savings Account Module: Beyond loans, Credit Lite offers a robust savings management system. You can create different savings products, manage deposits and withdrawals, calculate interest, and generate account statements for clients.

- Borrower & Client Management: Actively manage your client base with detailed profiles for each borrower. You can track their loan history, savings activity, and personal information, effectively turning the system into a mini-CRM for your institution.

- Role-Based Access Control: Assign specific roles and permissions to your staff. Administrators, loan officers, and cashiers have different levels of access, ensuring data security and operational integrity.

- Powerful Reporting & Analytics: Generate crucial financial reports, including collection sheets, profit and loss statements, balance sheets, and repayment reports. These insights are vital for making informed business decisions.

The entire package is built on a modern tech stack—Laravel for the backend and Vue.js for the frontend—ensuring a fast, secure, and scalable platform. You can explore the full feature list on its official CodeCanyon page.

Usability and Interface

For a system handling complex financial data, a clean and intuitive user interface is non-negotiable. Credit Lite excels in this area. The dashboard is modern, well-organized, and presents key metrics at a glance, such as total loans disbursed, outstanding balances, and recent transactions. The use of Vue.js for the frontend creates a smooth, single-page application (SPA) experience, meaning pages load quickly without constant browser refreshes.

Navigation is straightforward, with a logical menu structure that makes it easy for loan officers to manage applications or for an admin to pull up branch performance reports. The forms for adding new borrowers, loans, or savings accounts are clear and guide the user through the process efficiently. Furthermore, the system is fully responsive, ensuring that staff can access and manage information on desktops, tablets, or even mobile devices while in the field. This focus on user experience minimizes the learning curve and boosts productivity for your entire team.

Security and Performance

When dealing with financial information, security is the top priority. The Credit Lite script is built on the Laravel framework, which comes with robust, built-in security features that protect against common web vulnerabilities like SQL injection and cross-site scripting (XSS). The developers have implemented proper data validation and sanitation to ensure the integrity of your financial data.

Performance is equally impressive. The combination of a powerful Laravel backend and a reactive Vue.js frontend results in a fast and efficient application. Database queries are optimized for speed, ensuring that reports generate quickly and the system remains responsive even with a large volume of transactions and users. Regular updates from the developer also mean that the script is continuously improved with new features, bug fixes, and security patches, providing peace of mind for long-term use.

Pricing and Value

One of the most attractive aspects of the Credit Lite system is its pricing model. Unlike many SaaS (Software as a Service) solutions that charge recurring monthly or annual fees, Credit Lite is available on CodeCanyon for a one-time purchase price. This gives you lifetime access to the script and its source code. For a financial institution, this model provides incredible long-term value, eliminating ongoing subscription costs.

The standard license includes six months of professional support from the developer, which can be extended for a small additional fee. Considering the depth of features—multi-branch support, integrated loan and savings modules, and robust reporting—the one-time cost represents an excellent return on investment. It empowers you to own, host, and even customize your management system without being locked into a vendor’s ecosystem.

Credit Lite: Pros and Cons at a Glance

| Pros | Cons |

|---|---|

|

|

Frequently Asked Questions (FAQs)

1. What is the Credit Lite Management System?

Credit Lite is a self-hosted PHP script designed for microfinance institutions, credit unions, and other lending businesses to manage their loans, savings, clients, and multiple branches from a single, centralized platform.

2. Who is this script for?

It’s ideal for SACCOs, micro-lenders, credit unions, and any financial organization that needs to manage a loan and savings portfolio, especially those with multiple physical branch locations.

3. What technical skills are needed to install it?

You will need a web hosting environment that supports PHP and MySQL (like a standard cPanel hosting). Basic knowledge of uploading files via FTP or a file manager and creating a database is required. The documentation provided with the script guides you through the process.

4. Is the system secure for handling financial data?

Yes. It is built on the secure Laravel framework and employs standard security practices to protect your data. However, it’s also crucial to ensure your hosting environment is secure.

5. Can I customize the script to fit my needs?

Absolutely. Since you receive the full source code upon purchase, you or your developer can modify and extend the script to add custom features or integrate it with other systems.

6. Where can I buy the Credit Lite PHP script?

You can purchase and download the Credit Lite Multi Branch Loan & Savings Management System PHP script exclusively from the CodeCanyon marketplace, which is part of the Envato Market network.

7. Does it support different currencies?

Yes, the system is designed to be flexible and typically allows you to set your default currency and formatting to suit your region’s needs.

8. Is a live demo available to test?

Yes, the developer provides a live demo link on the CodeCanyon product page, allowing you to explore the user interface and test the features before making a purchase.

Final Verdict: Is Credit Lite Worth Buying?

After a thorough review, the answer is a resounding yes. The Credit Lite Multi Branch Loan & Savings Management System PHP script is a top-tier solution for any financial institution looking to digitize and streamline its operations. Its powerful multi-branch architecture, comprehensive feature set, and modern technology stack set it apart from the competition. While it requires self-hosting, the long-term value of a one-time purchase is undeniable.

If you need a reliable, scalable, and cost-effective system to manage your lending and savings business, Credit Lite is an investment that will pay for itself many times over in efficiency and control. This is more than just a script; it’s a complete business management tool. Ready to upgrade your operations? Get Credit Lite on CodeCanyon today and take full control of your financial institution’s future.

“`