Contents

Summary

Eskrow Secure Escrow Platform is a powerful, SaaS-ready PHP script that lets you launch a secure online escrow service. It’s perfect for developers, SaaS founders, and freelancers who want to build a trusted payment protection platform for buyers and sellers.

👉 Buy Eskrow on CodeCanyon

What Is Eskrow Secure Escrow Platform?

Eskrow is a PHP-based escrow payment platform designed to help users make secure transactions online. Buyers and sellers can safely exchange money for goods or services with funds held until all conditions are met. It’s ideal for marketplaces, freelancers, agencies, or anyone needing an extra layer of payment protection.

Who is it for?

-

Developers launching a secure escrow site for buyers and sellers

-

SaaS founders building niche escrow services for freelancers or marketplaces

-

Agencies wanting to add escrow to existing platforms

-

Freelancers who want to resell or deploy escrow for clients

Check it out on CodeCanyon here: Eskrow on CodeCanyon

Key Features of Eskrow Secure Escrow Platform

-

Fully functional escrow payment system

-

Buyer and seller dashboards with transaction tracking

-

Dispute management and resolution tools

-

Payment gateway integration for secure deposits and payouts

-

Commission system for earning fees on transactions

-

Multi-currency and multi-language support

-

Clean, modern responsive design

-

Detailed transaction logs and admin controls

-

SaaS-ready PHP script with multi-user support

-

Email notifications and status updates for transparency

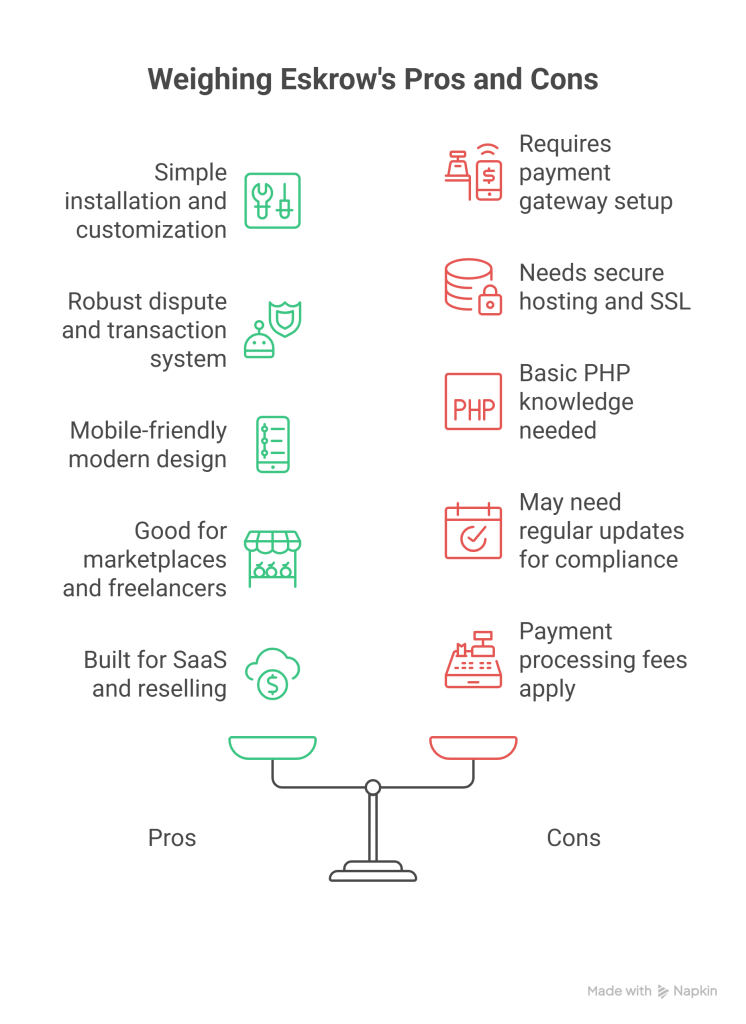

Pros and Cons

| Pros | Cons |

|---|---|

| Simple to install and customize | Requires payment gateway setup |

| Robust dispute and transaction system | Needs secure hosting and SSL |

| Mobile-friendly modern design | Basic PHP knowledge needed |

| Good for marketplaces and freelancers | May need regular updates for compliance |

| Built for SaaS and reselling | Payment processing fees apply |

Installation and Setup Guide

Installation Steps:

-

Download Eskrow files from CodeCanyon.

-

Upload all files to your web server.

-

Create a MySQL database and configure connection details.

-

Run the built-in installer or follow the manual install steps.

-

Log in to the admin dashboard to set up payment gateways, fees, and user roles.

Requirements:

-

PHP version 7.4 or higher

-

MySQL 5.7+ database

-

Apache or Nginx server with mod_rewrite enabled

-

SSL certificate for secure transactions

-

VPS or dedicated hosting recommended for high transaction sites

Check the official documentation here: Eskrow Documentation

Pricing and License Options

| License Type | Price | Usage Rights |

|---|---|---|

| Regular License | $69 | Single domain escrow site, no reselling rights |

| Extended License | $299 | SaaS version, multiple domains, or resale |

👉 Buy Eskrow on CodeCanyon: http://1.envato.market/B09AoB

Final Verdict – Is It Worth Buying?

Eskrow Secure Escrow Platform is one of the best SaaS-ready PHP scripts for launching a safe, trusted online escrow service. It’s feature-rich, developer-friendly, and flexible enough for marketplaces, freelance sites, or niche SaaS platforms.

Who should buy?

-

Developers who want a ready-made escrow system

-

SaaS founders adding secure payments to a platform

-

Agencies or freelancers building client sites needing escrow

Who should skip it?

-

Complete beginners with no PHP or hosting experience

-

Projects that don’t require secure transaction handling

Overall, Eskrow is a solid choice for anyone serious about building a secure, trusted payment exchange site.

👉 Buy Eskrow now on CodeCanyon: http://1.envato.market/B09AoB

FAQs

1. Can Eskrow handle disputes automatically?

Eskrow has built-in tools for dispute management and admin resolution.

2. Is Eskrow mobile-friendly?

Yes, it has a fully responsive design for all devices.

3. Can I add my own payment gateways?

Yes, the script supports popular gateways and custom API integration.

4. Do I need a dedicated server?

A VPS or dedicated server is recommended for high-volume sites.

5. Is there support and documentation?

Yes, the script comes with full documentation and seller support.

3 thoughts on “Eskrow Secure Escrow Platform Review: The Ultimate SaaS-Ready PHP Script for Secure Payments”