Contents

Summary

PayEscrow Online Payment Processing Service is a secure PHP escrow payment script for developers, startups, and SaaS founders. It lets you build a trusted payment gateway for buyers and sellers, with transaction tracking, dispute management, and commission control. 👉 Check PayEscrow on CodeCanyon.

What Is PayEscrow Online Payment Processing Service?

PayEscrow Online Payment Processing Service is a SaaS-ready PHP script for creating your own escrow-based online payment platform. It allows secure transactions between two parties by holding funds until both sides meet agreed conditions.

This script is ideal for freelancers, marketplace owners, developers, and SaaS founders who want to launch a self-hosted escrow payment system for digital products, freelance services, or online marketplaces.

Key Features of PayEscrow Online Payment Processing Service

-

Complete escrow payment system for secure transactions

-

Buyer and seller dashboards with transaction tracking

-

Built-in commission and fee management

-

Dispute management and resolution tools

-

Multi-currency and multi-payment gateway support

-

KYC (Know Your Customer) verification options

-

Responsive design for web and mobile

-

Clean admin panel for managing users, disputes, and payments

-

Detailed reports for transaction history and revenue

-

Developer-friendly, well-documented codebase

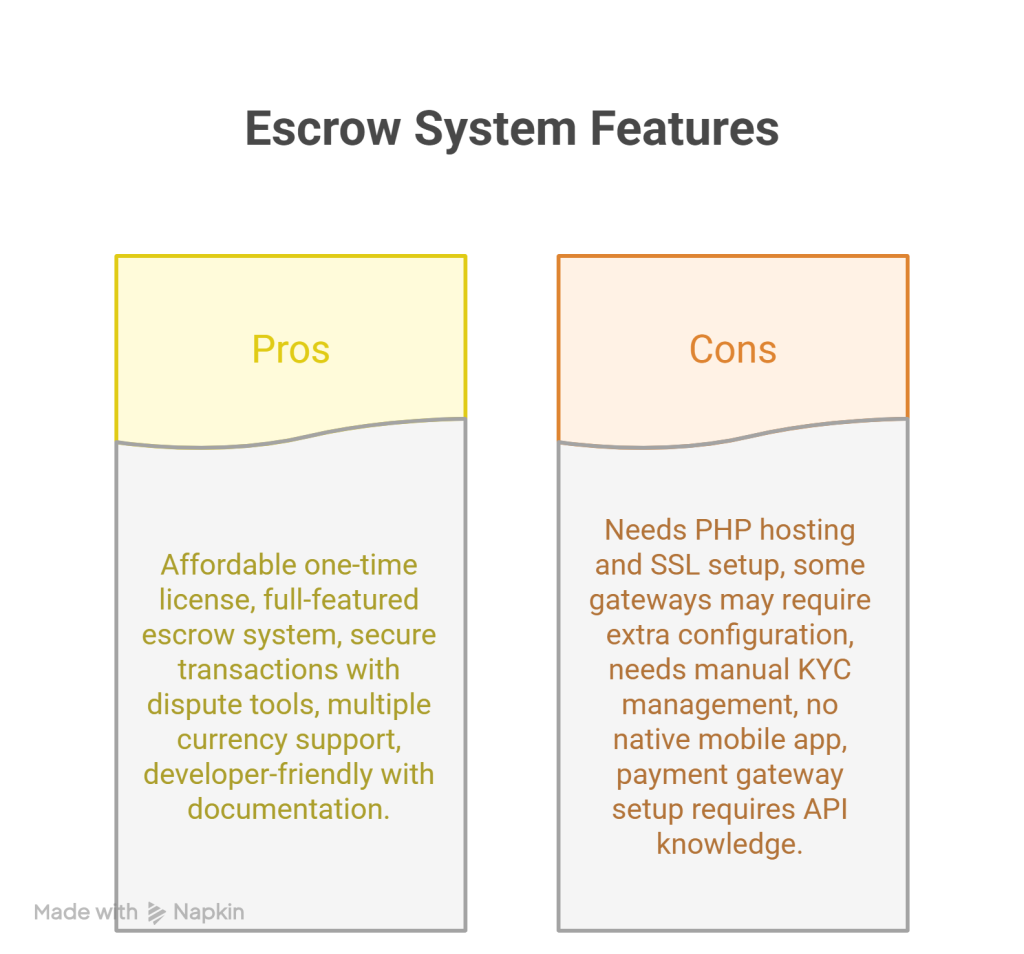

Pros and Cons

| Pros | Cons |

|---|---|

| Affordable one-time license | Needs PHP hosting and SSL setup |

| Full-featured escrow system | Some gateways may require extra configuration |

| Secure transactions with dispute tools | Needs manual KYC management |

| Multiple currency support | No native mobile app |

| Developer-friendly with documentation | Payment gateway setup requires API knowledge |

Installation and Setup Guide

Installing PayEscrow Online Payment Processing Service is simple for anyone familiar with PHP hosting.

Steps:

-

Buy and download the script from CodeCanyon.

-

Upload the files to your web server via FTP or cPanel.

-

Create a MySQL database and user.

-

Run the installation wizard to connect your database and create admin credentials.

-

Configure payment gateways, commission rates, and KYC rules.

-

Test the entire transaction flow before going live.

Requirements:

-

PHP 7.4 or higher

-

MySQL database

-

Shared or VPS hosting with SSL certificate

👉 View the official documentation

Pricing and License Options

| License | Regular | Extended |

|---|---|---|

| Usage | Single end product, no resale | Single end product, resale allowed |

| Price | $$ (see CodeCanyon) | $$ (see CodeCanyon) |

| Support | 6 months included | 6 months included |

| Updates | Lifetime | Lifetime |

👉 Buy PayEscrow Online Payment Processing Service on CodeCanyon – Get It Here

Final Verdict – Is It Worth Buying?

PayEscrow Online Payment Processing Service is an excellent PHP escrow script for businesses needing secure transactions between buyers and sellers. It’s packed with escrow-specific features like dispute resolution, commission settings, and KYC management — giving you full control over your own payment platform.

If you want to avoid monthly subscription fees and own your escrow platform, PayEscrow is a smart choice for marketplaces and service providers.

👉 Launch your secure payment platform: Buy PayEscrow on CodeCanyon.

FAQs

1. Does PayEscrow support multiple currencies?

Yes, you can process payments in multiple currencies.

2. Can I use PayEscrow for a freelance marketplace?

Absolutely — it’s designed for any platform needing escrow payments.

3. Does it include a dispute resolution system?

Yes, admins can manage disputes between buyers and sellers.

4. What payment gateways are supported?

Popular gateways are supported; some may need API setup.

5. Do I get lifetime updates?

Yes, plus 6 months of support included with your purchase.

4 thoughts on “PayEscrow Online Payment Processing Service Review – Best PHP Escrow Script”