Contents

Summary

VenVoice is a dynamic, self-hosted PHP invoice management system built for freelancers, agencies, and businesses. It lets you create, manage, and track invoices easily with a user-friendly dashboard, recurring billing, and multiple payment methods. 👉 Buy VenVoice on CodeCanyon

What Is VenVoice – Dynamic Invoice Management?

VenVoice is a powerful PHP script for creating, managing, and automating invoices and payments. Built with modern web technologies and intuitive UX, it helps professionals and businesses streamline their billing processes with ease.

Who Is It For?

VenVoice is ideal for:

-

Freelancers needing client invoicing tools

-

Small businesses automating recurring billing

-

SaaS founders who want to integrate a dynamic invoicing module

-

Agencies and developers looking for a self-hosted invoice management solution

Key Features of VenVoice

-

Easy-to-use admin dashboard

-

Create and manage invoices in minutes

-

Client management with profiles and histories

-

Recurring billing and payment reminders

-

Multiple currency & payment gateway support (PayPal, Stripe, Razorpay)

-

PDF invoice generation and download

-

Invoice filtering, search, and reporting

-

Responsive design (works on mobile/tablets)

-

Built with Laravel and Bootstrap

-

Role-based user access

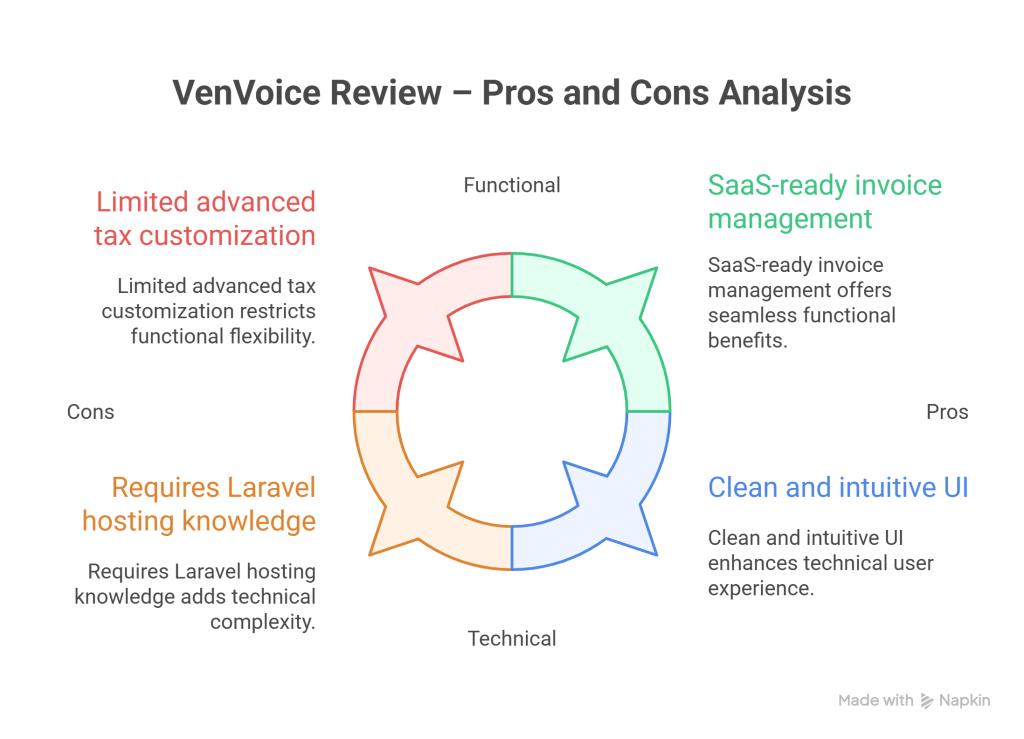

Pros and Cons

| Pros | Cons |

|---|---|

| Clean and intuitive UI | Limited advanced tax customization |

| SaaS-ready invoice management | Lacks built-in analytics dashboard |

| Supports multiple payment gateways | Not a full accounting solution |

| Laravel-powered backend | Requires Laravel hosting knowledge |

| One-time purchase | May require developer setup for customizations |

Installation and Setup Guide

Installation Steps:

-

Upload the script to your server via FTP or file manager.

-

Create a new MySQL database.

-

Open the script’s installer (

/install) in your browser. -

Follow on-screen steps to configure database and admin login.

-

Finish installation and log into the dashboard.

Requirements:

-

PHP 8.1 or higher

-

MySQL 5.7+

-

Laravel-supported hosting (shared/VPS/cloud)

📄 Check documentation (available with purchase)

Pricing and License Options

| License | Price (One-time) | Use Case |

|---|---|---|

| Regular | $39 | Single client invoicing or internal business use |

| Extended | $129 | SaaS platform or commercial resale |

👉 Buy VenVoice on CodeCanyon: http://1.envato.market/k0vb2x

Final Verdict – Is It Worth Buying?

VenVoice is a solid choice for anyone needing a Laravel-based invoice management script. It’s easy to set up, cleanly designed, and offers essential invoicing features like recurring billing, payment integration, and PDF invoices — without ongoing fees.

You should buy if:

-

You need a reliable invoicing system without paying monthly SaaS costs

-

You’re a freelancer, agency, or SaaS founder wanting full control over your billing

-

You want a customizable, self-hosted Laravel-based script

You should not buy if:

-

You need a full accounting suite

-

You’re unfamiliar with Laravel or PHP hosting setup

👉 Ready to simplify invoicing? Buy VenVoice on CodeCanyon

FAQs

1. Is VenVoice suitable for SaaS invoicing platforms?

Yes, with the extended license, you can build SaaS platforms using VenVoice’s invoicing features.

2. Does VenVoice support PayPal and Stripe?

Yes, it supports PayPal, Stripe, Razorpay, and offline/manual payments.

3. Can I create recurring invoices?

Yes, VenVoice includes support for recurring billing and auto-reminders.

4. Is the script mobile responsive?

Yes, the UI is fully responsive and works smoothly on all devices.

5. Do I need Laravel knowledge to install it?

Basic Laravel hosting familiarity is helpful, but setup is guided and beginner-friendly.

2 thoughts on “VenVoice Review – Dynamic Invoice Management PHP Script for Professionals”